Don’t work for money; make it work for you.

Robert Kiyosaki

I have tried to make investment interesting to my 9-year-old son a few times, however, unsuccessfully.

My (many) unsuccessful attempts…

Firstly, I tried to explain the concept of investing. I said that he would have to create a money machine which could work for him. It did not sound interesting to him. I guess that is because he gets enough money to satisfy his needs now.

Then at some point of time I made an Excel sheet with compound interest calculation. It showed him that if he invests a few euros now, in 10 years time they would become a huge sum of money. That did not catch his attention either. I guess that is because 10 years time for a 9-year-old seems like an eternity.

Thirdly, I tried to show him how peer-to-peer lending platform works. As it is possible “to see” real people you are lending your money to, I thought he might find it interesting. He was interested in the process – he found a person whom he wanted to lend and we made an experiment – lended 10 euros to him. But that was it. No more interest in this subject.

Fourthly, I suggested that I would mirror the amount he invested. He did not seem to be interested in that either (does he have too much money?).

I made a conclusion that he is too young for this subject. So I postponed further teaching lessons until he shows some interest.

Success – finally!

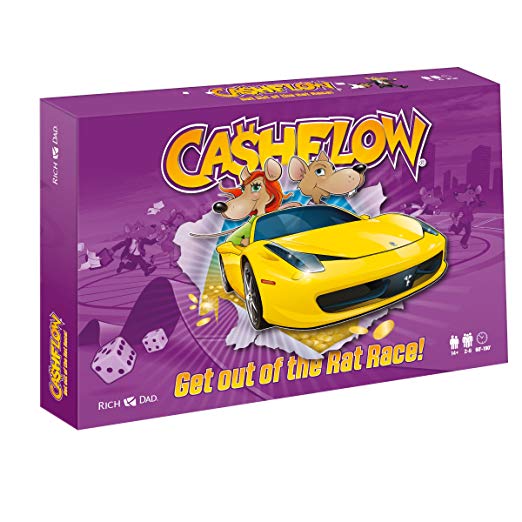

But one day we found a game online called “Cashflow Classic”. It is enough to register and you can play the game for free!

Why is this game worth trying with your kid?

- The aim of Cashflow Classic is to get out of the rat race, i.e. to make your passive income greater than your expenses. Have your parents taught you how to get out of the rat race? If not, wouldn’t it be amazing to teach that your kid?

- The cost of things in the game is very similar to real life (costs of shares, real estate, baby, etc.). On the contrary, the Game of Life has some “extreme” costs, e.g. 50 k for a pet party.

- Other numbers are also very close to real life – your salary (depending on profession), interest on loans, income from rent, etc.

- Cashflow Classic teaches investment strategies in stocks, real estate and business. You can try various tactics and see whether that pays off. You can become rich or you can go bankrupt. The good thing is that your child can try these things before he goes into real life and loses his real money.

- Even if Cashflow Classic is made for adults, kids can quite quickly understand where the most important numbers are.

Below I give you some more information about the things your kid (and you!) can learn from the game:

| What can you learn? | Comments |

| Earn passive income | This is the most important thing the game teaches you |

| Active income basics | Everybody starts with earning certain amount of active income. The aim is to show that it does not matter that much how much active income you earn |

| Expenses basics | It reflects real life situation – taxes, home mortgage payment, student loan and car payments are all here |

| Difference between assets and liabilities | When you make a decision you may not be sure whether you invest in asset or liability. But you soon see it in your balance sheet and you understand what it is |

| Investment basics | The game teaches when and where it is worth investing; when it is worth selling; how investment affects your assets and liabilities |

| Borrowing basics | The game teaches when and how much it is worth borrowing; how borrowing costs are calculated; how borrowing costs affect your cashflow |

| Importance of cashflow | Your decisions depend on the amount of cash you have at hand. So, always keep an eye on the cashflow! |

The amazing results

After the long evening playing Cashflow with Faustas, he was so excited about the “1 dollar stocks” (these are very cheap stocks which you might buy if you are lucky and then sell them for 30 or 40 dollars later) that he was literally jumping around! And after we finished, he said:

“Mom, could we start investing today?”

“It’s too late. We have to go to sleep now”, I replied.

“OK, mom, but could we do that tomorrow? Could I lend money to people, in that platform you showed me the other day?”, he asked.

“Of course, we could. But not now.”

“And remember, you told me that if I invest my allowance money, you would give me the same amount?” Faustas asked again.

Amazing, I thought. I tried to make investment interesting to him many times. And it did not work out. But this Cashflow game showed him that he could actually get rich if he invests – and that was enough to drive his interest. Would you try it with your kids?

Do you want to test how good you are at teaching financial freedom? Take the Financial IQ test for Parents now!